![]() — Home — Business News

— Home — Business News

Weekly Business News from Myanmar

-

Yoma Bank and Maha Agriculture Public Co has announced the completion of a MMK 3.5 million (USD2.6 million) funding agreement in support of Maha Agriculture’s lending activities in Myanmar, which will enable Maha Agriculture to reach an additional 6,000 f

Yoma Bank and Maha Agriculture Public Co, a local microfinance institution, yesterday announced the completion of a K3.5 billion ($2.6 million) funding agreement in support of Maha Agriculture’s lending activities in Myanmar. The agreement will enable Maha Agriculture to reach an additional 6,000 farming families, a sector which has so far been underserved by formal financial institutions. The company will deploy the funds to help farmers buy fertilisers, seeds and other agricultural inputs. It will also lend to smaller microfinance enterprises in support of their business activities. Maha Agriculture currently services 10,000 farming families across Myanmar, with an aggregate loan book of K7 billion. “The agriculture sector is the backbone of Myanmar’s economy and employs 70 percent of the country’s labor force. [Yet], many farmers have little to no access to credible lenders. This drives them to borrowing from informal moneylenders with high interest rates, diminishing any profits,” said Matteo Marinelli, CEO of Maha Agriculture. He added that Maha Agriculture “aims to provide more small, unsecured loans to farmers, vendors and micro enterprises.” -

Despite the difficulties and the government’s insufficient attention to deal with economic issues, some meaningful progress has been made on the economic front: the new Investment Law, new Companies Law, rules to the Condominium Law, and improvements in Y

The last fiscal year was a tough one for the economy owing to the Rakhine crisis and the government’s insufficient attention to deal with economic issues. But despite the difficulties, some meaningful progress has been made on the economic front, with the new Investment Law coming into force, new Companies Law signed into approval and rules to the Condominium Law finally released. On a municipal level, businesses were impressed by the reforms in Yangon’s transport, notably the introduction of Uber and Grab, as well as the Yangon Bus Service (YBS), though the latter has its fair share of controversies. In fact, economic growth and a surge in foreign direct investments (FDI) compared to the previous year were supported by the initial phase of economic liberalisation, with investors attracted by Myanmar’s status as one of Asia’s last frontier markets, according to the International Monetary Fund (IMF). But the Fund warned that a second wave of reforms, especially in the banking system and further opening up the economy to joint foreign ventures, is necessary to maintain the momentum. -

Ministry of Hotels and Tourism plans to promote tourism by developing new modes of tourism and new tourist destinations to attract tourists: eco-tourism, cultural tourism, and community-based tourism in resource-rich areas

Myanmar's Hotels and Tourism Ministry is striving to promote tourism by developing new modes of tourism and creating new tourist destinations. The ministry has permitted about 1,628 hotels and guest houses with some 65,470 rooms to operate as of March 31, official Global New Light of Myanmar reported. As of December 2017, the ministry had also granted over 2,676 travel agencies, issuing 4,503 tour guide licenses, 3,449 regional tour guide licenses and 2,564 transport licenses. The ministry is also striving to promote eco-tourism, cultural tourism and community-based tourism in resource-rich areas, including historical landscapes, rivers, lakes, beaches, islands and forests. -

Together with Myanmar’s HTOO Group, South Korean’s NongHyup Financial Group will start a financial service for farming equipment business in Myanmar, and will seek cooperation in other financial sectors such as banking and insurance

South Korea’s NongHyup Financial Group Inc. together with Myanmar’s HTOO Group will start a financial service for farming equipment businesses in the Southeast Asian country in the second half with this year, the company said Sunday. Two parties had signed a memorandum of understanding to cooperate on setting up a financial service business for the distribution of farming equipment in Myanmar January this year. They will launch a joint task force team to work on detailed business planning by mid-April and finalize the contract by the end of June for full-fledged service start in July. The Korean financial group will lead its project in Myanmar through its subsidiary NongHyup Finance Myanmar that it set up in 2016. The group raised the subsidiary’s capital to $8 million late last year from its initial investment of $3 million. It plans to expand NongHyup Finance Myanmar’s business by adding five more outlets to its current nine branches with an aim to increase the number of customers to 50,000 from current 28,000. -

Internal Revenue Department will reward those who provide the information on establishments that fail to pay commercial taxes

The government is raising its efforts to collect taxes from commercial enterprises. Last week, the Internal Revenue Department said it will reward those who provide information on establishments that fail to collect commercial taxes, according to state media. Under the law, consumers who buy goods and services in Myanmar are liable to pay commercial taxes. This will be included in the total bill presented by the goods or service provider. The customer will be given a receipt affixed with official tax stamps, signifying that commercial taxes have been paid on the transaction. The commercial taxes will be collected by or remitted to the government. The goods and service providers include restaurants, hotels and jewelry shops, among others. Should a customer not be presented with a receipt or if the receipt is not affixed with the appropriate tax stamps, he or she can lodge a complaint with the IRD in exchange fore rewards ranging between K20,000 and K100,000. Informants’ identities will not be revealed. -

State-owned Myanma Petrochemical Enterprise (MPE) plans to build a new oil refinery near an existing state- run facility in Magwe Region, which will have a capacity of two million tones per year (Daw Yin Yin Aung, Deputy Director of MPE)

State-owned Myanma Petrochemical Enterprise (MPE) is planning to build a new oil refinery near an existing state-run facility in Magwe Region, Daw Yin Yin Aung, deputy director of MPE, told The Myanmar Times. The government intends for the project to be implemented in cooperation with the private sector under a Public Private Partnership, in line with Myanmar’s economic policy. The capacity of the new refinery will be 2 million tonnes per year. It will use crude oil feedstock from the South East Asia crude oil pipe line, which runs across Myanmar from a terminal on the coast of Rakhine State to Yunnan province in China. The pipeline, which began operations in 2015, was first developed by China National Petroleum Corporation in 2008. The Chinese own a controlling stake in the pipeline, while the government holds the remaining stake. Crude oil is transported via the $2.5 billion pipeline and exported to China. The Ministry of Electricity and Energy (MOEE) has granted approval for the new refinery to buy 2 million tonnes of oil from the South East Asia Crude Oil Pipeline Company, which controls the pipeline. -

Yangon Regional Government plans to implement an inland port project in Hlaing Tharyar Township to streamline transportation of goods using waterways

Yangon Regional Government is planning to implement an inland port in Hlaingtharyar Township to streamline transportation of goods using waterways. The project is being planned near the Nge Pin Le industrial zone and A Le village in Hlaingtharyar Township, but the regional government has not mentioned a proposed completion date. The project is called the ‘Ngwe Pin Le Integrated Logistics Zone & IWT Jetty Link Dry Port Project.’ Its market sounding was held on April 4, and was attended by businessmen in the transportation sector. ‘‘Waterway transport is the cheapest mode of transportation. However in Yangon land transportation is mainly used. Therefore, we are planning to implement water transportation as soon as we can,’’ Daw Ni Lar Kyaw, a regional minister for electricity, industry and transport, said. -

Greater Mekong sub-region countries have adopted a framework worth $66 million that will be implemented in five years: the framework will expand the economic corridor among the countries and connect urban and rural areas

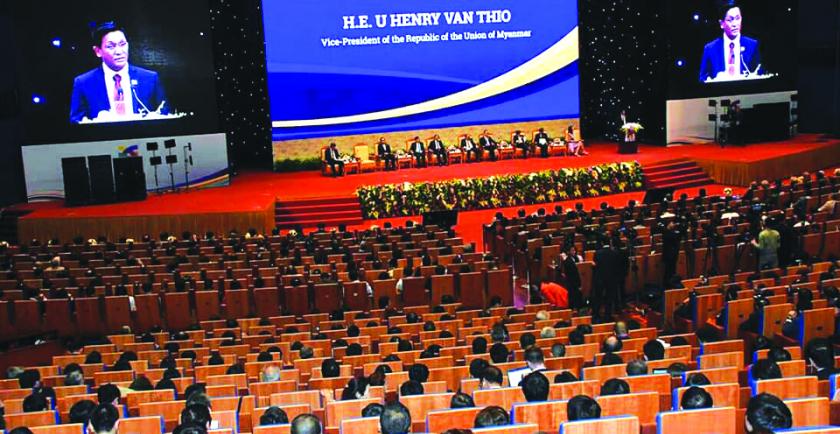

Greater Mekong sub-region countries have adopted a framework worth $66 million that will be implemented in five years. “Myanmar agrees with the framework and will actively take part in the framework.” U Henry Vanthio, Myanmar’s Vice President No.2, said at the Greater Mekong Sub-region Economic Cooperation summit held on March 31 in Vietnam. The summit of Greater Mekong sub-region countries, Thailand, Myanmar, Laos, China, Cambodia and Vietnam defied Hanoi Action Plan and the Regional Investment Framework. Myanmar's Vice President said that Myanmar believes it will be able to collect funds which will help implement the action plans of the 2022 framework. This includes 226 projects of investment and technical assistance in Myanmar which supports the new GMS Transportation Strategy of 2018-2030 among Greater Mekong sub-region countries. -

Dr. Maung Maung Thein, former minister for Finance and Planning, pointed out five constraints that make banks hesitant to grant loans to SMEs: lack of statistics, more than one business statistics record, inability to provide complete statistics, weakness

Dr. Maung Maung Thein, former minister for Finance and Planning, pointed out five constraints that make banks hesitant to grant loans to SMEs during the event of SME Financing Landscape in Myanmar: A Multifaceted Approach. He pointed out that most SMEs lack statistics, have more than one business statistic record, are unable to provide complete statistics, are weak in laying out a business plan and do not own immovable properties. “They are weak in having complete statistics. Banks always look at the statistics. They also keep more than one record. For instance, one for his wife and one for himself,” he said. The first four facts can be addressed, he said, by raising financial knowledge and the last fact can be overcome by making credit insurance business develop. -

Additional loans to be disbursed to profit-making small and medium enterprise (SMEs) after a review on their investments and progresses (U Khin Maung Cho, Union Minister of Industry)

Additional loans will be disbursed to profit-making small and medium-sized enterprises after a review of their investments and progresses, said Union Minister for Industry Khin Maung Cho. For the business expansion of SMEs, the government is carrying out the issuance of recommendations for the availability of loans from respective banks and the submission of loan applications under the Credit Guarantee Insurance (CGI) system. Till February 15, the Co-operative bank disbursed Ks 2,283 million loan to 225 SMEs, the Small and Medium Industrial Development Bank, Ks 200 million to 10 SMEs and Kanbawza Bank, Ks 295 million to four SMEs.

Business News

Copyright © 2014 Business Information Center All Rights Reserved.