![]() — หน้าแรก — เกาะติดข่าว

— หน้าแรก — เกาะติดข่าว

ข่าวเศรษฐกิจและธุรกิจประจำสัปดาห์

-

The Central Bank of Myanmar (CBM) instructed banks to install security alarm system at their nationwide branches

The Central Bank of Myanmar (CBM) instructed banks nationwide to install an alarm bell system at their branches similar to those used internationally to beef up security. Arrangements are being made to inform the banks to install security alarm systems like those in other countries, said U Soe Min, vice governor of CBM. “We have also instructed banks to tighten the working hours of security guards such as their night shifts or day shifts and to have the guards serve overtime with the permission of head office," the vice governor said in response to the question raised by U Toe Win, MP of Tarmwe constituency, Yangon, at Pyithu Hluttaw session held on May 25, on whether there was a plan for the safety of customers in the event of a bank robbery. -

Most of the foreign enterprises have invested in the manufacturing sector in the seven months of the current financial year

Most foreign enterprises primarily invested in the manufacturing sector in the seven months of the current financial year 2019-2020, the Directorate of Investment and Company Administration (DICA) stated. According to state media, of 162 foreign enterprises permitted and endorsed by Myanmar Investment Commission and the respective investment committees between 1 October and April-end of current fiscal, 126 enterprises pumped FDI into the manufacturing sector. -

The Internal Revenue Department (IRD) expands list of e-payments platforms for taxpayers

Taxpayers will now be able to pay taxes digitally without having to physically visit the local tax office, the Internal Revenue Department (IRD), which is under the Ministry of Planning, Finance, and Industry announced May 25. The e-payment services will be made available by local banks. Starting May 25, taxpayers will be able to pay tax using Ayeyarwady Bank's (AYA Bank) online banking platforms as well as the AYA Pay mobile application. Currently, taxpayers are able to pay their taxes using CB Bank's internet and mobile banking services as well as on the IRD's website using their corporate debitcards provided by the Myanmar Payment Union. The IRD is now working on enabling e-payments of tax using the online payment platforms available at other local banks. A list of approved banks will be announced in due course. -

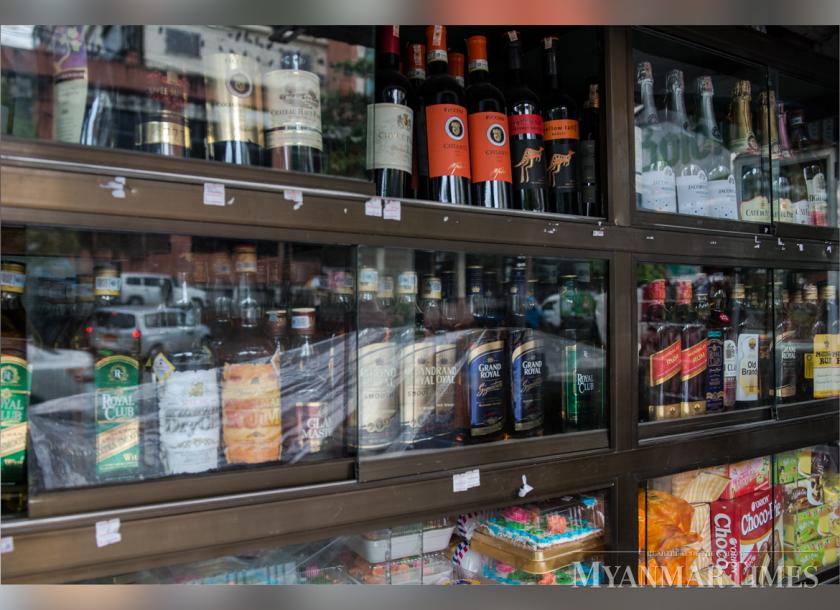

Ministry of Commerce issued foreign liquor import guideline in Myanmar to relax Myanmar’s decades – old ban on alcohol imports

The Ministry of Commerce on May 25 issued regulations designed to relax Myanmar’s decades-old ban on alcohol imports. The ministry’s “Guidelines for the Importation of Foreign Liquor” allows foreign spirits with the cost, insurance and freight value of US$8 or above to be brought in from Yangon ports and the Yangon International Airport. “Before, alcohol and beer and cigarettes were not allowed to be imported. It is now permissible to import liquor,” said U Ko Ko Naing, deputy director of the Ministry of Commerce. Imports of spirits have been tightly restricted in Myanmar since 1962. The current ban was introduced by the military government in 1995. U Thein Sein’s government permitted the import of wines in late 2015, but only hotels and duty-free outlets have been allowed to import spirits and beer until now. -

Real Estate sector fetched over K 27.8 billion in three months in 2019 – 2020 financial year

Over 730 units of apartment were sold at a property expo which earned over K27.8 billion in three months in 2020, according to the report of the iMyanmarHouse.com. A leading Myanmar real estate website has successfully hosted two expos and 26 private property expos in three months from January to March. At these expos, more than 730 units of real estate were sold for K27.8 billion (over US$19 million). Out of two, one took place in Singapore while the remaining one was hosted at Pullman Hotel in Yangon in cooperation with AGD bank. The 26 private properties expo were held at hotels and other project location places. “The year 2020 is one of the good years for iMyanmarHouse.com. The sale of the property has increased over 60 per cent in three months in 2020 compared to 2019. After three months in 2020, the coronavirus started to break out in Myanmar and the real estate expos had to be suspended. However, iMyanmarHouse.com is still providing its service through online. iMyanmarHouse.com wants to stand as a good platform in any situation in Myanmar’s real estate sector,” said Managing Director U Nay Min Thu of iMyanmarHouse.com. -

Government plans to take USD $ 60 million loans from the Asian Development Bank (ADB) to establish a Credit Guarantee Corporation (CGC) in Myanmar’s SMEs sector

Myanmar is planning to take a US$60 million loan from the Asian Development Bank (ADB) to establish a Credit Guarantee Corporation (CGC), U Maung Maung Win, the Deputy Minister for the Ministry of Planning, Finance, and Industry, said in Parliament on May 21. The proposal was sent by the President. U Maung Maung Win said small and medium enterprises (SMEs) in Myanmar lack a credit guarantee system which limits the amount of unsecured loans the banks are able to extend to an SME. In Myanmar, 98pc of the economy comprises SMEs, while 95pc of the workforce is employed by this sector, according to government data. Yet, bank lending for business in Myanmar comprises just 37 percent of GDP, which is low compared to other countries in the region. “Establishing the CGC will help solve the problem of SMEs having insufficient collateral and documentation, which prevents them from getting a loan from the banks,” he said. -

The investors urged government to extend the deadline of a tender to get more time to prepare bids

The Ministry of Electricity and Energy has issued a tender for 1,060 megawatts of on-grid solar power but given investors just a month to prepare bids at a time when they are unable to enter or travel around the country. Investors and analysts have urged the government to extend the deadline of a tender for up to 1,060 megawatts of solar power, arguing that bidders have not been given enough time to prepare proposals and the government is unlikely to get the best possible price. The Ministry of Electricity and Energy’s Electric Power Generation Enterprise announced the tender on May 18, setting a closing date of June 18 for bids. The tender covers 30 sites and invites proposals for projects ranging from 30 to 50MW. The winning bidders will be granted 20-year concessions. The tender had been eagerly anticipated and was expected to attract strong interest from foreign investors. But the decision to call it during the COVID-19 outbreak and with a short window to prepare proposals has been greeted with dismay and anger, souring what should have been a milestone for the power sector and a major success story for a government keen to attract foreign investment. -

The role of Public – Private Partnership (PPP) is very important to fight against COVID – 19 pandemic

The World Health Organization (WHO) announced COVID-19 can be characterized as pandemic on 11th March, 2020. We have already been through the impact of this pandemic before the outbreak hit our own lands. When it does happen, the government is the first to respond in any country. As the virus is new, we still have a lot yet to learn over time. This is a long term battle for the human being and the sector of PPP plays a key role to fight against COVID-19. As the State Counsellor, Daw Aung San Suu Kyi said, “People are the Key”. We would like to mention that we all need to know the 5As to fight against COVID-19: Asymptomatic Carrier, Avoid Crowded Places, Activate Immunity, Active Community Participation and Attitude towards using Masks, Handgel, Handwashing and Physical Distancing. To implement 5As, the role of PPP is very important. One way to prevent this catastrophe is to reduce the number of new cases per day by preventing people from being exposed to infected individuals through physical distancing, thereby reducing the probability of new infections. Moreover, taking private healthcare providers into confidence, training them where necessary and planning a cost-cutting strategy to relay the benefit to the people may lighten the burden on public healthcare system in such scenarios. Such a symbiotic association will benefit the general public greatly in the face of a healthcare emergency. -

Yangon Stock Exchange (YSX) and six securities firms asked to beef up anti-money laundering compliance and disclosure

The Yangon Stock Exchange (YSX) and six securities companies were requested by the regulator to beef up their compliance and disclosure in line with its anti-money laundering regulations. The Securities and Exchange Commission (SECM), in a May 18 announcement, identified “insufficient information collection and reporting procedures” for both the bourse and the firms in following the 2016 anti-money laundering and counter-terrorism financing instruction, after a recent official inspection. The regulator conducted the first inspection on the bourse and the third inspection on six securities companies between August 2019 and January 2020. The YSX also needs to strengthen its internal control system, such as setting up an audit committee, and expand the number of staff, according to the announcement. -

Government will borrow K 1.3 trillion from the Central Bank of Myanmar (CBM) to plug the budget deficit for fiscal 2019 – 2020

The government will borrow K1.3 trillion from the Central Bank of Myanmar (CBM) to plug the budget deficit for fiscal 2019-20, deputy minister for Planning and Finance U Maung Maung Win told Pyidaungsu Hluttaw on May 21. This is expected to be around 20 percent of total borrowings to fund the deficit. It also indicates a further decline in CBM borrowing from 25pc over the past two fiscal years and over 50pc in 2016-17. Prior to that, the CBM funded the bulk of the country's deficits. The lower levels of CBM borrowing is in line with the country's plan to reduce its reliance on central bank financing and more on bond financing. Under the Budget Law for the fiscal year, the actual amount that the government can raise through borrowings, including bonds, shall not be more than K9 trillion.

เกาะติดข่าว

Copyright © 2014 Business Information Center All Rights Reserved.