Ministry of Planning and Finance will allow foreign insurance firms to invest in Myanmar

9 มกราคม 2562

Ministry of Planning and Finance will invite a submission for Expression of Interest (EOI) and Request for Proposal (RFP) from foreign insurers as well as local ones in January, according to the ministry’s announcement on January 2. This will be the first time since 2013 that the ministry allows private insurers in to the insurance sector, in 2013 they allowed 11 local private insurance companies.

“The government has been talking about allowing foreign insurers for a long time. This is the first official announcement. We have nothing to complain about, the decision to allow foreign insurers is necessary for the improvement of the country. However, we are worried that local insurance companies with little experience will have a hard time competing with foreign insurance companies,’’ U Thaung Han, Secretary of Myanmar Insurance Association, told Myanmar Business Today.

The Ministry of Planning and Finance said that this decision will make available the funds needed which are essential for economic development of the country and will improve non-banking financial sector.

The ministry’s announcement cited Section 29 of the Insurance Business Law, which says that the Ministry of Planning and Finance, with the approval of the government, can grant permission to a company which wishes to operate an insurance business, underwriting agency or insurance broking with foreign investment.

The Ministry of Planning and Finance laid out three options for foreign life insurance companies to operate insurance business.

The first option is to grant not more than three licenses to foreign insurers as 100 percent wholly owned subsidiaries.

Option two is to allow foreign life insurers with a representative office in Myanmar to form joint venture with local life insurers.

In addition, non-life insurance providers with a representative office in Myanmar will be able to form a joint venture with a local non-life insurer.

While foreign life insurers have strong technological and financial background with years of experience, local insurers have only about 5 years’ experience. Thus, the insurance community believes that local insurers need to be well prepared to compete with foreign insurers.

“Of course, foreign insurers have a lot of advantages in terms of technologies. However, it is too early to say it is good or bad because we don’t still know how they will come in to the local insurance market. Our local insurers can’t cover remote areas. It would be great if they could cover the population that can’t be reached yet. We have prepared to compete with foreign insurers,’’ an official from Aung Thitsar Oo Insurance Company told Myanmar Business Today.

Insurers hope that the number of people who buy insurance policies reach 2.5 percent of the total population of 53 million in 2030 from current percentage of 0.1 percent.

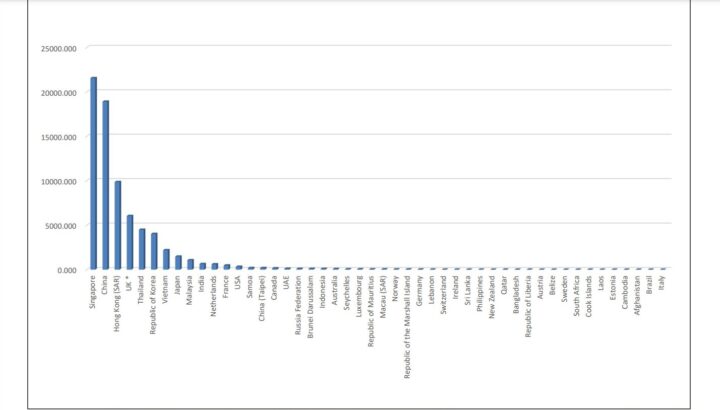

In comparison to Myanmar, 5 percent of Malaysia’s 31 million population have insurance with 150,000 insurance brokers, 2.5 percent of Vietnam’s 95 million population have insurance with 450,000 insurance brokers and 8 percent of Singapore 6 million population have insurance.

Myanmar Insurance was launched in 1952 and operated by the government. The Government for the first time, allowed five private insurers on May 25, 2013, four private insurers on June 14, 2013 and two private insurers on October 6, 2014.

The ministry’s January 2 announcement said that they will allow local insurance companies or joint ventures to provide life insurance or general business insurance separately and invited local and foreign insurers to submit EOI and RFP.

(Myanmar Business Today: https://www.mmbiztoday.com/articles/ministry-planning-and-finance-allow-foreign-insurers-myanmar )